Issue 177: Brand Focus Report - IWC

An in-depth analysis of IWC, its product portfolio, brand image and future outlook

Hello and welcome back to The Fourth Wheel, the weekly watch newsletter that is diving deep into IWC. As promised a few weeks back, one new addition to TFW is going to be regular brand reports. These are something between a journalistic profile of the company and an external consultant’s analysis; I take all publicly available information on the brand, my own experiences of it over the last 15 years, whatever insights I might have privately gleaned from industry insiders, and weave the whole thing together into a comprehensive overview of the company’s position and outlook. These are really long posts, even by my standards, and the paywall kicks in a lot earlier. I appreciate everyone who contributed their anecdotal feedback about IWC, and hope you enjoy the write-up.

For these reports, I’m picking companies that I think have an element of over- or under-performance about them and a strong mainstream fanbase. If there are brands you’d like to see get this treatment, let me know.

The Fourth Wheel is a reader-supported publication with no advertising, sponsorship or commercial partnerships to influence its content. It is made possible by the generous support of its readers: if you think watch journalism could do with a voice that exists outside of the usual media dynamic, please consider taking out a paid subscription. You can start with a free trial!

Here’s a little taste of what you might have missed recently:

Before we get started, here’s one little head-scratcher I’d like to throw open to the court. In 2023 Hermes revealed the H08 monopusher chronograph (H1837 calibre, Dubois Depraz chrono module). It turns out it hasn’t actually been making or selling them, and this week reintroduced the watch with a new colour scheme (yellow instead of orange) and a bigger case, up from 41mm to 44mm. This kind of thing happens more often than you’d think; most brands wait to bring models to market when they’re 100 per cent confident, but unforeseen circumstances often force their withdrawal. I asked Hermes, and was told that apparently the 2023 version was only ever a concept - a detail that must have evaded everyone at the time of release. Whether the increase in case size is a reaction to market research, a fix for a case that wasn’t quite as strong as required, or something else entirely, we can only speculate.

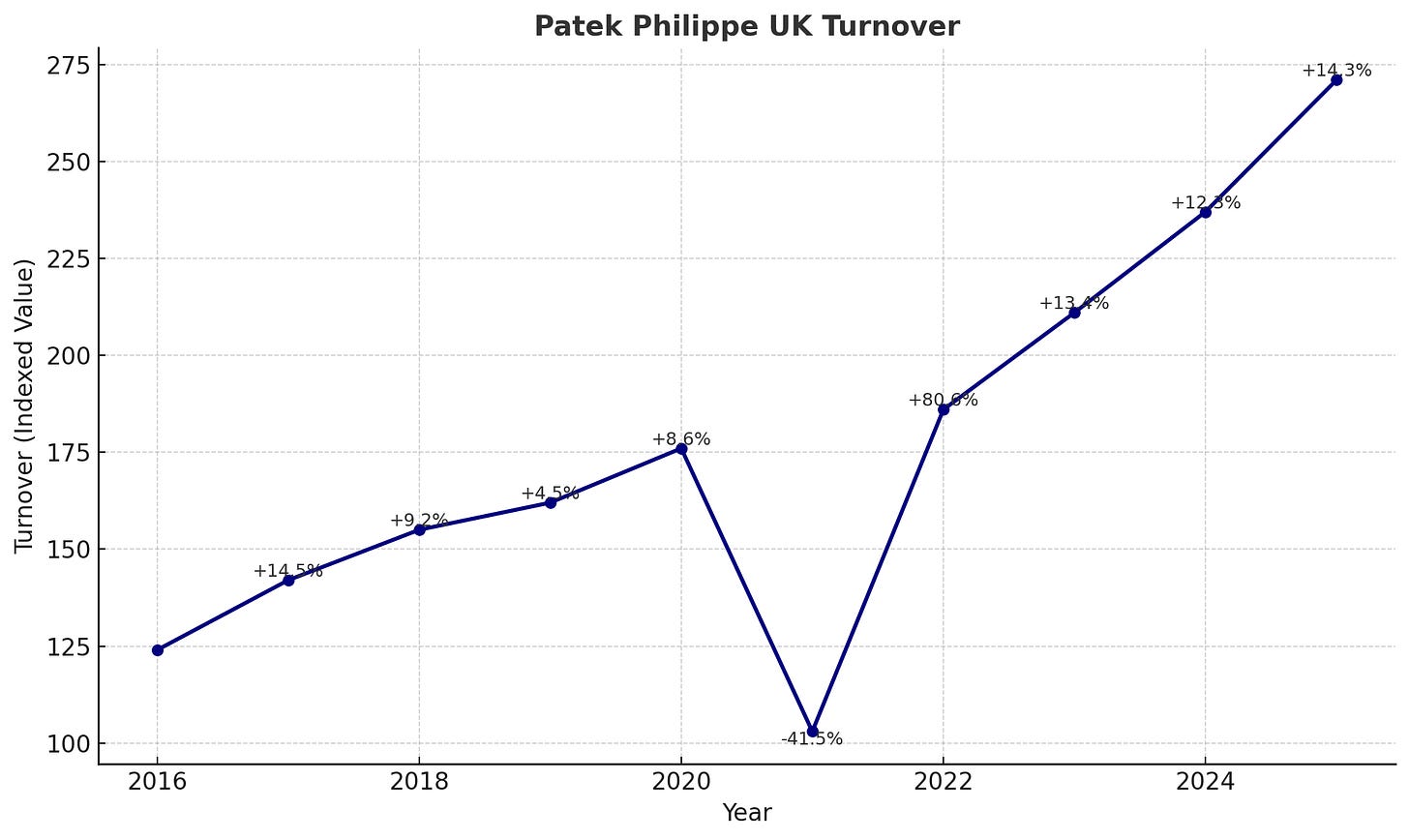

Patek Philippe UK filed its accounts this week. They show that revenue was up 14 per cent, to a total of £271m, with profits rising by 20 per cent to £17.2m after tax. If we take Morgan Stanley’s figures as broadly accurate1 that means that Patek Philippe’s UK operations alone would rank as the 25th highest-earning watch brand in the world, just below Van Cleef & Arpels and above A. Lange & Sohne, which is estimated to make CHF 250m annually.

Looking back at the last decade we can see that - Covid notwithstanding, where revenues briefly tanked - the brand has not only grown steadily but actually increased its rate of growth in the last three years.

Two other details stood out to me from the annual accounts: firstly, the company saw sales revenue grow, but revenue from servicing - a comparatively tiny £3.2m a year - actually fell by 5 per cent. Probably within normal deviation, to be honest, but the brand has never previously itemised it on its turnover, otherwise I’d be curious to know if there’s a micro-trend of fewer owners bringing their watches in for repair. The second thing definitely isn’t within normal bounds: the percentage of EU sales rose by a third - 34 per cent - from £15m to £20m. That’s an interesting development, while still a small slice of the UK business, given we’ve generally been hearing that tourist revenue has dropped off a cliff since Brexit.

Brand Focus: IWC

I’ll not waste too much time with an introduction. You all know IWC: the International Watch Company, headquartered in Schaffhausen, northern Switzerland and founded in 1868 by the superbly named Florentine Ariosto Jones. Jones introduced more modern industrial practices gleaned from US watchmakers (and other industries, including armaments), and sited his company in Schaffhausen in part for its ready supply of hydro-generated power.

In the 21st century IWC created one of the earliest modern pilot’s watches, the Special Watch for Pilots, in 1936 before going on to supply watches to both Allied and Axis forces in World War 2. It created the Portugieser in the late 1930s and the Ingenieur in the mid-1950s. It survived the ‘quartz crisis' by the skin of its teeth, working with Porsche Design to produce its first generation of wristwatches, before undergoing a period of renaissance in the late 1980s under Gunter Blumlein. With the technical input of Kurt Klaus the brand introduced the Da Vinci Perpetual Calendar, ceramic cases and the ‘warhorse of Schaffhausen’, Il Destriero Scafusia Grand Complication. In 1991 it became part of the LMH group alongside Jaeger-LeCoultre and A. Lange & Sohne, and in 2000 the group was bought by Richemont, where IWC remains. Its current product line-up includes the Big Pilot, Pilot’s Chronograph, Portugieser, Portofino, Ingenieur and Aquatimer families.

I’m going to walk through the product line-up with my thoughts on its strengths and weaknesses, then talk about the brand’s other activities; its marketing narratives, partnerships, vintage market performance and finish with my thoughts on what it might need to think about for the next few years.

Keep reading with a 7-day free trial

Subscribe to The Fourth Wheel to keep reading this post and get 7 days of free access to the full post archives.